About Tim Emery

How do we keep investors interested in UK property?

I would like to start by saying that I am a first year university student with no experience of the industry, so I am simply drawing from my own observations and experiences.

Such is the level of anomalous growth in London compared to the rest of the UK that I think we have to treat it as a separate situation. Whilst for the majority of the UK, the question is how to keep investors interested in UK property, I think in London the question is how do we manage the growth in property investment to ensure it is sustainable. As we have seen many times before a buoyant property market that is limited to a capital city can often cause unsustainable growth driven by greed, based on foreign investment, with little foresight. As someone passionate about the diverse cultures that currently thrive in London, what may happen to those cultures if luxury property in the capital is left dormant for much of the year due to foreign ownership and the general population are priced out of the market in swathes of the city? So I suppose there would have to be an active effort driven by banks with governmental support to regulate the sector in a way that would be beneficial for all parties to ensure the property bubble surrounding London does not burst.

So then we move over to the question of attracting investment to the rest of the UK. Whilst the property market is in the process of recovery, many people are still finding it very difficult to find a buyer for their house at this time. However, when my parents sold their house of 16 years earlier this year it sold within a week of going on the market. What was clear is that this was due to its location and surrounding infrastructure. It was situated within walking distance to a recently opened, very sought after secondary school, was close to the local shops and was in an area that had good rail links into London. If we compare that to a family friend who is also trying to sell their house not 8 miles away, despite lowering the asking price is still struggling to find a buyer after 9 months. So really I think making the UK continually attractive to property investors is conditional on infrastructure. Though it would be easy to look to governmental investment in schools etc. in more deprived areas, due to the continuing economic burden this would be unrealistic. Instead I believe we need to look to private industry to attract outside investors. I think the creation of jobs in areas of potential development would make these areas more appealing to investors, but also ensure the private industry firms be well placed to receive the new residents into working positions, which will in tern bring retail companies to the area due to the higher levels of employment and disposable income. I think this would not only attract investors, but would be beneficial to the economic recovery, with the final piece of the puzzle being eventual governmental investment in education in these areas to safeguard the continued growth.

Featured articles and news

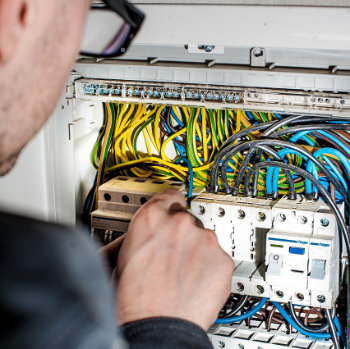

Focussing on the practical implementation of electrification.

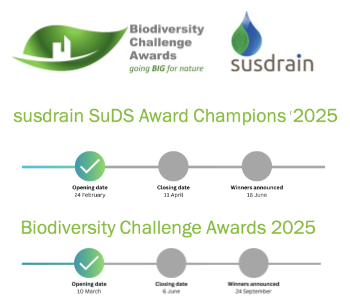

Sustainable Urban Drainage and Biodiversity

Awards for champions of these interconnected fields now open.

Microcosm of biodiversity in balconies and containers

Minor design adaptations for considerable biodiversity benefit.

CIOB student competitive construction challenge Ireland

Inspiring a new wave of Irish construction professionals.

Challenges of the net zero transition in Scotland

Skills shortage and ageing workforce hampering Scottish transition to net zero.

Private rental sector, living standards and fuel poverty

Report from the NRH in partnership with Impact on Urban Health.

.Cold chain condensing units market update

Tracking the evolution of commercial refrigeration unit markets.

Attending a conservation training course, personal account

The benefits of further learning for professsionals.

Restoring Alexander Pope's grotto

The only surviving part of his villa in Twickenham.

International Women's Day 8 March, 2025

Accelerating Action for For ALL Women and Girls: Rights. Equality. Empowerment.

Lack of construction careers advice threatens housing targets

CIOB warning on Government plans to accelerate housebuilding and development.

Shelter from the storm in Ukraine

Ukraine’s architects paving the path to recovery.

BSRIA market intelligence division key appointment

Lisa Wiltshire to lead rapidly growing Market Intelligence division.

A blueprint for construction’s sustainability efforts

Practical steps to achieve the United Nations Sustainable Development Goals.

Timber in Construction Roadmap

Ambitious plans from the Government to increase the use of timber in construction.

ECA digital series unveils road to net-zero.

Retrofit and Decarbonisation framework N9 launched

Aligned with LHCPG social value strategy and the Gold Standard.